In a significant move that’s sending ripples through the tech industry, Microsoft has recently canceled 200MW worth of AI data center leases. This decision is part of a larger withdrawal from over 1GW of planned capacity, marking an important shift in how the tech giant approaches its AI infrastructure strategy. This strategic recalibration reflects deeper changes in the AI landscape and offers valuable insights into the future of AI infrastructure development.

Why Microsoft Is Canceling AI Data Center Leases

Microsoft isn’t backing away from AI – far from it. The company is still fully committed to its massive $80 billion infrastructure spending plan. What’s changing is how they’re spending that money and where they’re building their AI capabilities.

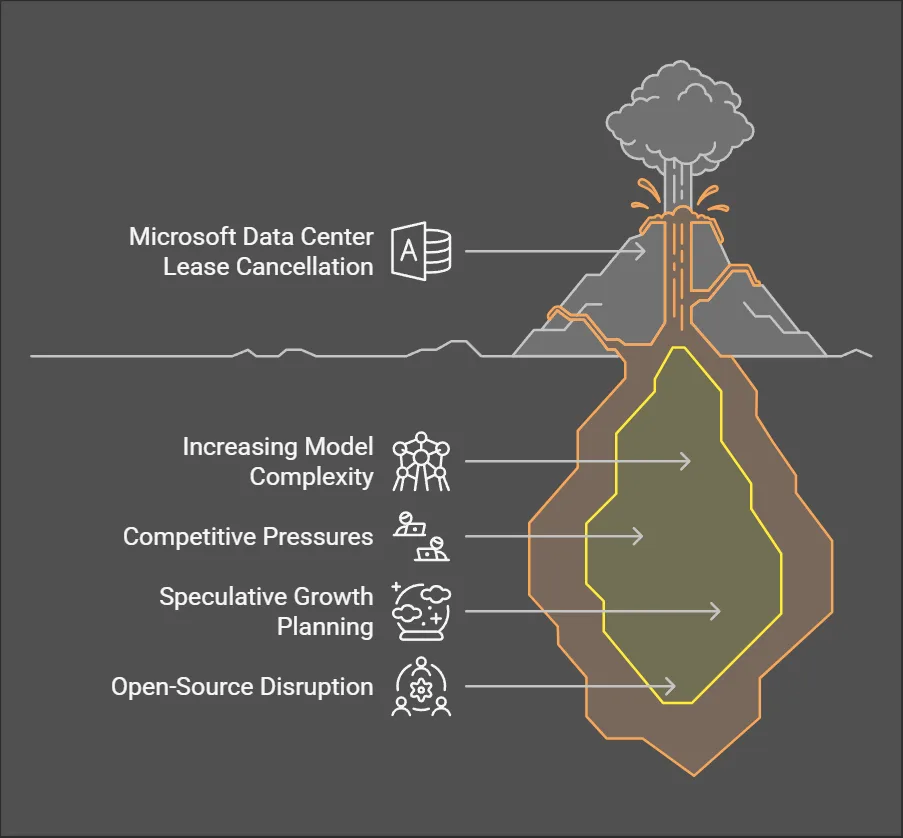

The End of the AI Gold Rush

The initial AI boom created unprecedented demand for data center space. In early 2024 alone, major tech companies leased 2.9GW of capacity, with Microsoft responsible for 38% of this activity. This massive expansion was driven by several factors.

- Increasing Model Complexity: The parameter count jumped dramatically from 175 billion in GPT-3 to 1.8 trillion in GPT-4. Each training cluster for these advanced models requires between 10-15MW of power.

- Competitive Pressures: Microsoft’s $13 billion investment in OpenAI created an urgent need for guaranteed computing power to support ChatGPT and Microsoft’s Copilot services.

- Speculative Growth Planning: Anticipating rapid growth in AI-as-a-Service offerings, Microsoft and other tech giants pre-leased capacity 18-24 months in advance.

- However, the market has cooled significantly in recent months for several reasons:

- Open-Source Disruption: Models from companies like DeepSeek in China and Mistral in Europe have achieved 93% of GPT-4’s performance while requiring 40% less computing power. This efficiency improvement has reduced the need for massive data center capacity.

- AI Utilization Challenges: Despite the hype, AI workload utilization rates have stalled at around 62%, well below the 75% threshold needed for profitable operation. This indicates that the anticipated demand hasn’t fully materialized as expected.

- Economic Realities Setting In: The initial gold rush mentality has given way to more careful financial analysis, with companies focusing on return on investment rather than sheer capacity.

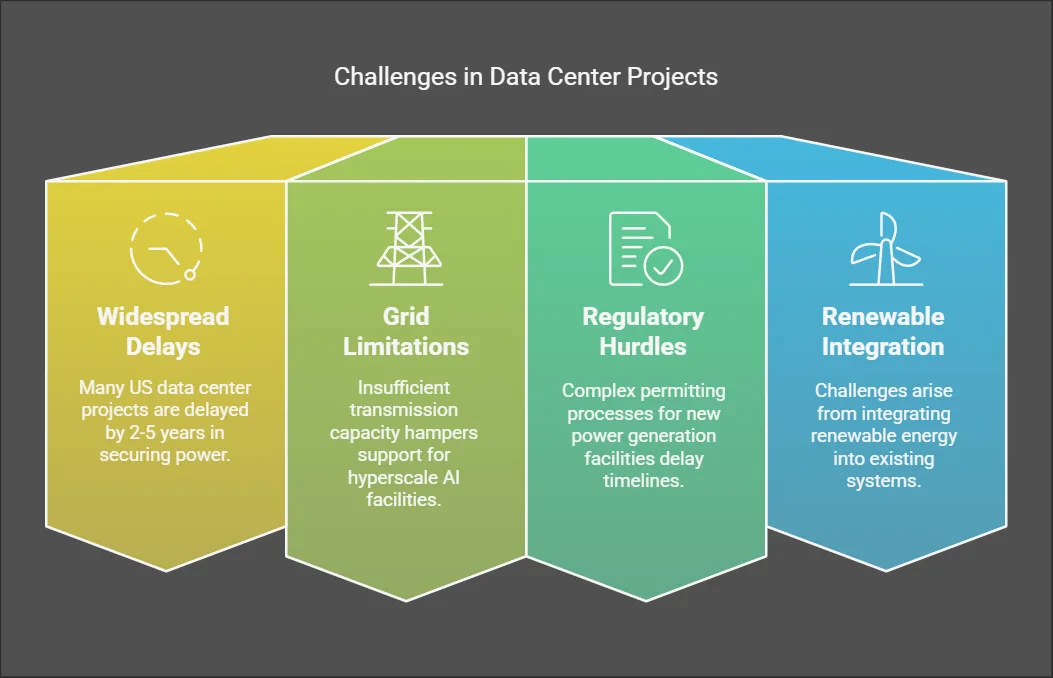

Power Constraints Becoming a Reality

The power requirements for AI data centers have created unprecedented challenges:

- Widespread Delays: About 78% of planned US data center projects are facing delays of 2-5 years in securing power, particularly in deregulated markets like Texas.

- Grid Infrastructure Limitations: Many regions simply don’t have the transmission capacity needed to support multiple hyperscale AI facilities.

- Regulatory Hurdles: Securing permits for new power generation facilities has become increasingly complex, with environmental reviews adding months or years to timelines.

- Renewable Energy Integration: Microsoft’s commitment to clean energy further complicates matters, as renewable resources often face their own development and integration challenges.

From International to Domestic Focus

Microsoft is making a dramatic shift in its global strategy:

- Massive Repatriation: Microsoft is shifting 60% of its planned international capacity back to US sites, particularly from Southeast Asia and Eastern Europe.

- Supply Chain Security: This move reduces exposure to international supply chain risks, where 43% of non-US data centers faced delays of over six months in GPU deliveries.

- Regulatory Concerns: The EU AI Act’s tiered compliance framework has added approximately 25% overhead to European projects, making them less economically attractive.

- Intellectual Property Protection: Keeping sensitive AI infrastructure within the US provides better protection for Microsoft’s proprietary technology and data.

Regional Impact of Microsoft’s Decision

Wisconsin’s Delayed Development

In Kenosha, Wisconsin, Microsoft has delayed a massive 315-acre campus, with far-reaching consequences:

- Employment Impact: 1,200 temporary construction jobs have been postponed, resulting in an estimated $45 million wage loss according to LIUNA 310, the local labor union.

- Power Market Disruption: We Energies now faces $78 million in contract penalties after securing 150MW of natural gas capacity specifically for Microsoft’s project.

- Economic Development Setback: Wisconsin’s ambitious $1 billion subsidy package, which included a 5% payroll rebate through 2040, is now being renegotiated under very different circumstances.

- Community Planning Challenges: Local governments had initiated infrastructure upgrades, zoning changes, and service expansions in anticipation of the project.

Atlanta’s Power Problems

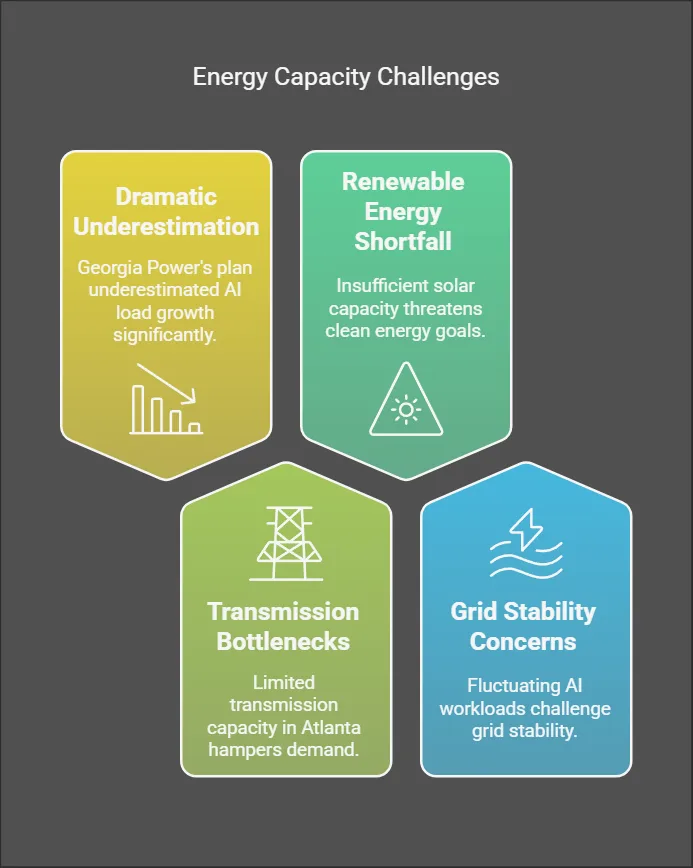

In Georgia, Microsoft is reconsidering a 450MW project due to serious infrastructure limitations:

- Dramatic Underestimation: Georgia Power’s 2023 Integrated Resource Plan underestimated AI load growth by a staggering 300%, creating a severe capacity gap.

- Transmission Bottlenecks: The Atlanta region has only 900MW of available 500kV transmission capacity against a growing demand of 1.8GW.

- Renewable Energy Shortfall: The scheduled 2026 delivery of 400MW of solar plus storage capacity is now insufficient for Microsoft’s 100% clean energy pledge.

- Grid Stability Concerns: The rapid fluctuations in AI workloads create unique challenges for grid stability that weren’t fully appreciated in earlier planning.

Market-Wide Effects of Microsoft’s Strategy Shift

Data Center REITs Under Pressure

The commercial real estate sector has felt immediate impacts from Microsoft’s lease cancellations:

- Stock Price Declines: Companies like Digital Realty saw a 5.2% drop, Equinix fell 3.8%, and QTS (directly impacted by cancellations) experienced a 9.1% decline.

- Leasing Activity Slowdown: Q2 2024 leasing activity across major REITs shows signs of cooling, with Digital Realty leasing 84MW, Equinix 67MW, and QTS just 42MW.

- Investor Confidence Shaken: The sudden shift has caused investors to question growth projections across the entire data center sector.

- Construction Pipeline Reconsideration: Many REITs are now reevaluating their development pipelines, potentially delaying or canceling projects that lack firm commitments.

Energy Market Adjustments

The 200MW withdrawal has caused significant ripple effects in regional energy markets:

- Price Impact: Capacity prices in the PJM Interconnection dropped $2.50/MW-day (4.3%) as planned demand evaporated.

- Reserve Requirements: In ERCOT, 45MW of quick-start reserves are no longer required, reducing balancing costs by 11%.

- Utility Investment Plans: Several utilities have placed transmission upgrades on hold pending clearer signals from hyperscalers.

- Regulatory Reconsideration: Energy regulators are reassessing how to account for AI loads in long-term resource planning, with some calling for specific AI load forecasting requirements.

Changing Semiconductor Demand

The hardware ecosystem is also experiencing significant impacts:

- NVIDIA Guidance Reduction: NVIDIA revised its Q3 2024 data center GPU guidance downward by 15% in response to changing demand patterns.

- AMD Gaining Ground: Microsoft is showing increasing preference for AMD’s MI300X chips, indicating a strategic shift toward heterogeneous computing architectures.

- Supply Chain Adjustments: Semiconductor manufacturers are adjusting production schedules and inventory levels to account for the changing demand landscape.

- Custom Silicon Development: Microsoft’s investment in custom AI chips like the Maia 100 AI Accelerator is accelerating, potentially reducing dependence on third-party suppliers.

Microsoft’s New Approach: Efficiency Over Scale

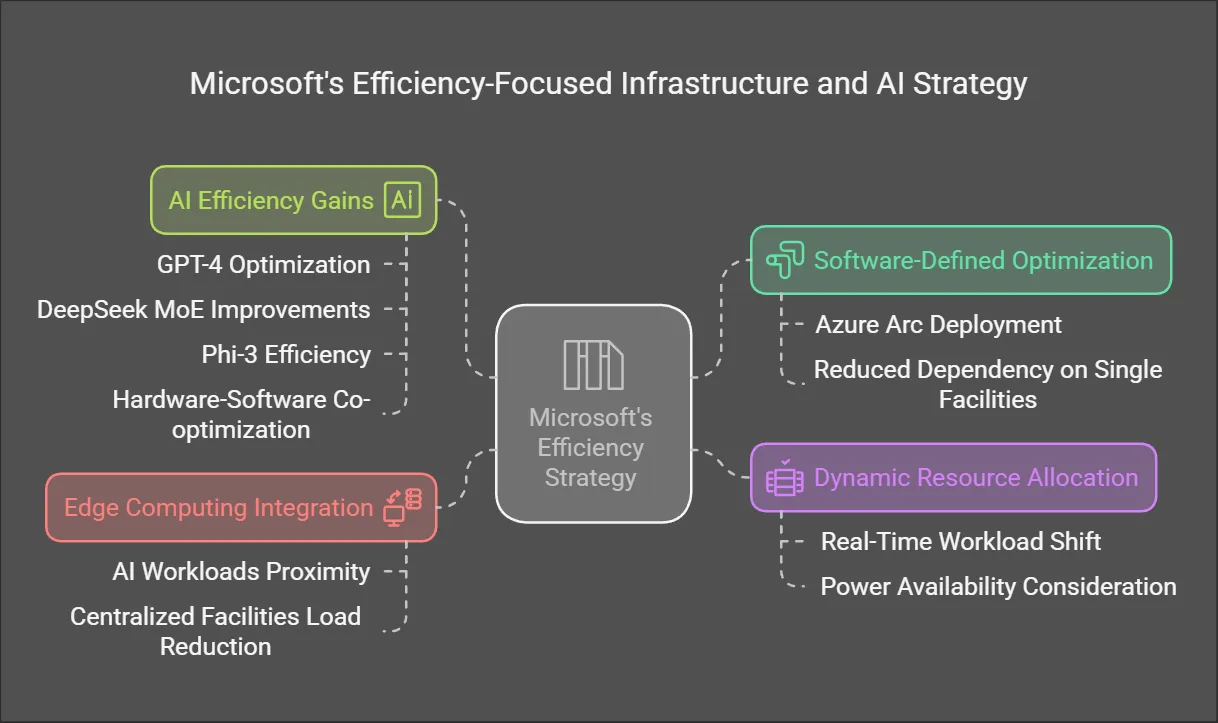

Rather than simply building more data centers, Microsoft is focusing on making its existing infrastructure more efficient through several innovative approaches:

Software-Defined Optimization

Microsoft’s infrastructure strategy now emphasizes flexibility and efficiency.

Azure Arc Deployment: This technology enables dynamic workload distribution across three tiers of infrastructure:

- 40 high-density core data centers (>50MW) with advanced liquid cooling

- 12,000 smaller Azure Modular Data Centers (AMDCs) at 500kW scale

- Partner colocation facilities for burst capacity needs

Dynamic Resource Allocation: Microsoft can now shift workloads in real-time based on power availability, cost, and performance requirements.

Reduced Dependency on Single Facilities: This distributed approach reduces reliance on monolithic leases and creates greater resilience.

Edge Computing Integration: Pushing certain AI workloads closer to users reduces latency while decreasing the load on centralized facilities.

Impressive AI Efficiency Gains

Microsoft has achieved remarkable improvements in AI model efficiency:

- GPT-4 Optimization: This flagship model now processes 80% more tokens per watt than in 2023.

- DeepSeek MoE Improvements: This model has seen a 35% efficiency gain, processing 3.1 times more tokens per watt than the 2023 GPT-4 baseline.

- Phi-3 Efficiency: Microsoft’s smaller Phi-3 model shows a 32% efficiency gain over its previous version, now processing 6.2 times more tokens per watt than the 2023 GPT-4 baseline.

- Hardware-Software Co-optimization: These gains come from tight integration between model architecture, software optimization, and hardware acceleration.

Technological Innovations Enabling Downsizing

Several technological breakthroughs have enabled Microsoft to reduce its data center footprint:

- Custom Silicon Advantages: Microsoft’s Maia 100 AI Accelerator achieves 2.1 times better performance per watt than NVIDIA’s H100 for LLM inference workloads.

- Model Compression Techniques: ONNX Runtime’s dynamic sparsity techniques have reduced BERT model sizes by an impressive 73% without accuracy loss.

- Cooling Breakthroughs: Deployments of two-phase immersion cooling in Quincy, Washington have improved power usage effectiveness (PUE) to an industry-leading 1.08.

- Workload Specialization: By optimizing infrastructure for specific AI tasks rather than general-purpose computing, Microsoft achieves much higher efficiency.

Financial Reallocation and Tax Strategy

Microsoft’s strategic pivot involves significant changes to its financial planning:

Revised Capital Allocation for FY2025

Microsoft has dramatically reshuffled its budget priorities:

- US Data Center Investment: Increased from $22 billion to $28 billion (+27%)

- International Data Centers: Reduced from $18 billion to $12 billion (-33%)

- AI Accelerator R&D: Boosted from $15 billion to $18 billion (+20%)

- Modular Edge Deployments: Significantly increased from $5 billion to $8 billion (+60%)

This reallocation shows a clear shift toward domestic facilities, edge computing, and proprietary technology development.

Tax Optimization Strategy

Microsoft is using these changes to optimize its tax position:

- Capital Loss Utilization: The lease cancellations trigger $1.2 billion in impaired capital losses, which can offset tax liabilities from $7 billion in AI service revenue.

- R&D Credit Maximization: Microsoft has increased R&D tax credit utilization by 40% through the CHIPS Act’s Advanced Compute provision.

- Domestic Investment Incentives: The shift toward US facilities takes advantage of various federal and state tax incentives for domestic technology investment.

Risk Management: Avoiding the Colocation Trap

Microsoft’s retreat from third-party leases helps mitigate several strategic risks:

- Oversupply Concerns: Industry projections suggest 23% vacancy rates for leased AI capacity by 2026, which could lead to price instability.

- Cost Structure Disadvantages: Per-unit compute costs are 19% higher in colocation facilities versus owned facilities due to margin stacking.

- Technical Limitations: Third-party facilities often cannot support advanced cooling technologies like direct-chip cooling, limiting Microsoft’s ability to deploy cutting-edge hardware.

Instead, Microsoft is prioritizing owned campuses with:

- Dedicated Power Infrastructure: Nine new 345kV on-site substations are under construction to ensure reliable power.

- Nuclear Energy Partnerships: Microsoft is working with Constellation to deploy small modular reactors (SMRs) that provide 24/7 carbon-free power.

- Full Design Control: Owned facilities allow for optimized layouts specifically designed for AI workloads rather than general-purpose computing.

Stakeholder Impact Across the Ecosystem

Microsoft’s strategic pivot affects a wide range of stakeholders:

Vendor Ecosystem Shifts

- NVIDIA’s Changing Position: Reduced data center lease capacity is leading to higher reliance on Microsoft’s Maia chips, which are projected to handle 25% of Azure AI workloads by 2025.

- Utility Company Adjustments: Duke Energy has postponed a $450 million transmission upgrade in South Carolina that was planned specifically for Microsoft’s expansion.

- Construction Industry Realignment: Turner Corporation has reallocated 300 workers from canceled projects to Wyoming’s TerraPower site, showing how labor markets adjust to these changes.

- Supply Chain Reconfiguration: From cooling equipment manufacturers to cabling suppliers, the entire data center supply chain is recalibrating to Microsoft’s new priorities.

Labor Market Adjustments

While 2,100 construction jobs were delayed, Microsoft’s strategic shift has created new opportunities:

Emerging Specializations: Microsoft announced 800 new roles focused on next-generation infrastructure:

- Liquid cooling systems engineering positions increased by 120%

- AIOps automation specialist roles grew by 90%

- Grid integration analyst positions expanded by 65%

Skill Transition Requirements: Workers need to develop expertise in new areas like immersion cooling, AI-optimized power distribution, and advanced monitoring systems.

Regional Impacts: Some areas losing data center projects are gaining infrastructure roles in power generation or transmission upgrades.

Future Outlook for AI Infrastructure

Predictions for AI Infrastructure Evolution

The industry is headed for significant changes:

- New Performance Metrics: Raw power capacity (MW) is being replaced by efficiency metrics like AI-Compute-Per-Watt (AICPW) as the key performance indicator.

- Regulatory Changes: FERC Order 901 may soon mandate AI load transparency in grid planning, fundamentally changing how utilities prepare for data center growth.

- Technological Convergence: We’ll likely see increased integration of quantum annealing systems (like Azure Quantum) to reduce classical compute needs for certain AI workloads.

- Specialized AI Facilities: The distinction between general-purpose data centers and AI-specific facilities will grow, with unique design standards for each.

Microsoft’s Strategic Roadmap

Microsoft has outlined an ambitious technology roadmap:

- 2025 Milestone: Deploy 50MW of nuclear-powered AI compute in Pennsylvania, setting new standards for carbon-free AI operations.

- 2026 Target: Achieve 95% reuse of AI model training heat via district heating partnerships, dramatically improving overall energy efficiency.

- 2027 Vision: Transition 40% of AI workloads to photonic processors, which promise orders-of-magnitude improvements in efficiency and speed.

- Long-term Goal: Develop an entirely new paradigm for sustainable AI infrastructure that decouples computational growth from energy consumption.

What This Means for the Future of AI Data Centers

Microsoft’s strategic adjustment shows that the AI infrastructure market is maturing rapidly:

- Industry Consolidation: Smaller players may exit the AI infrastructure space, leaving the field to hyperscalers like Microsoft and specialized providers like CoreWeave.

- Infrastructure Specialization: Generic data centers will give way to highly specialized facilities designed specifically for AI workloads.

- Power Grid Integration: The relationship between AI operators and utilities will become more collaborative, with shared planning and investment.

- Technological Diversification: Demand for heterogeneous compute architectures combining CPUs, GPUs, and quantum processing units will accelerate.

Policy Evolution: Governments must reconcile ambitious AI development goals with power grid realities through initiatives like the Department of Energy’s AI Compute Access Pilot Program.

By prioritizing efficiency, control, and long-term resilience over raw capacity, Microsoft is positioning itself for sustainable leadership in the AI era while establishing new industry standards for responsible growth. Rather than a retreat, this strategic pivot represents a more mature, sustainable approach to AI infrastructure development that will likely be emulated across the industry.